As artificial intelligence continues to evolve, more and more spheres of life are turning to this technology to better understand the world around them. AI in business is increasingly becoming integral to everyday operations, from healthcare to the financial industry.

Accounting is one of the oldest professions in the world, but it is also one of the most innovative. AI in accounting has been gaining traction in recent years, and for a good reason – it’s highly effective. The AI Adoption rate in US accounting is 16%, Statista says. Artificial intelligence in accounting is an emerging technology that can help accountants to automate their activities and processes.

For example, AI-powered accounting software can automate tracking and categorizing transactions. It can also help generate financial reports and analytics. As a result, businesses can save time and money and allow them to focus on core competencies.

Today, we’re offering you to dive into AI usage in accounting and how accounting can benefit from AI.

Types of AI used in accounting and their application real-life environments

In today’s ever-evolving world, accounting departments increasingly leverage AI to drive better decisions, greater efficiency, and improved accuracy. For these matters, they use machine learning, natural language processing, predictive analytics, and robotic process automation (RPA).

Machine learning for better security and efficient operations

ML is a subset of artificial intelligence that enables systems to learn from data, identify patterns, and make decisions with minimal human intervention. Machine learning development is designed to create means that will automate complex accounting processes, such as accounts receivable, accounts payable and general ledger. ML can also be used to identify fraud and irregularities in financial data and make better-informed decisions.

For instance, banks use machine learning for fraud detection analyzing customer transaction data. Although banks can detect potentially fraudulent activity by looking for patterns in customer activity, banks can see potentially fraudulent activity. This could include suspicious account activity, large transfers, or purchases from unfamiliar merchants.

The widely-used PayPal payment system utilizes machine learning to detect fraud. The algorithm forms and assesses associations in its data to accomplish this purpose. As a result, PayPal has a low fraud rate of 0.32% of revenue.

Also, ML can be used in CRM to improve customer service and create a more personalized customer experience. For example, AI in CRM can quickly analyze customer data and provide customized recommendations based on customer preferences and past interactions. This can help to improve the customer experience and increase customer loyalty.

Additionally, AI-enabled CRM systems can detect customer issues and provide resolutions quickly and efficiently, improving customer service.

Natural language processing for automated text analysis

NLP is a form of AI that focuses on understanding human language. It can recognize text patterns, detect word meanings, and extract essential insights from data. Regarding accounting, NLP can convert documents into valuable data, automate data entry, and understand customer queries.

NLP is used in accounting through chatbots. These can assist customers with their financial inquiries and automate specific tasks within the accounting process. For example, chatbots can be programmed to understand customer questions and provide the correct answers. This can reduce the number of customer service inquiries and free up time for accountants to focus on other tasks.

For example, the Bank of America has a chatbot into its banking application. Users can make requests to the chatbot via text and voice messages and give a command to the chatbot. Then, the chatbot analyzes the request and opens the desired function.

Also, NLP can be used to process invoices and financial documents automatically. Using NLP, accountants can quickly and accurately analyze documents, extract meaningful information, and generate reports. This can save businesses time and money and make accounting processes more efficient.

The benefits of NLP for audits have been discovered by KPMG, a provider of audit, tax, and advisory services, by automating the interpretation of financial information. NLP was instructed to read various documents to search for and find the required information. As a result, thanks to the fact that an NLP program can read thousands to millions of pages in a small portion of the time needed by a human to complete the same task, the overall performance was more efficient and faster.

Generative AI to enhance efficiency

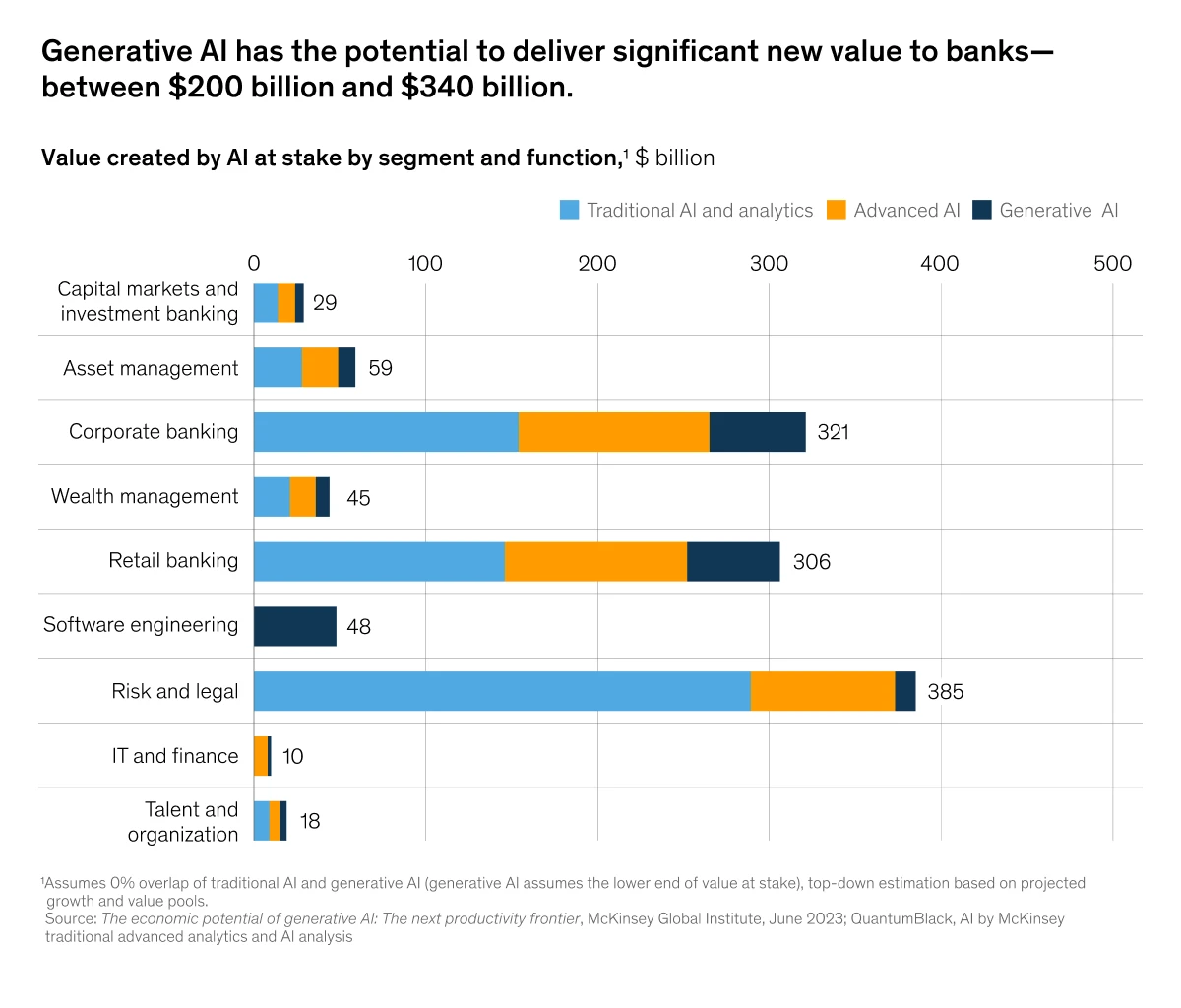

Generative AI has the potential to revolutionize various aspects of banking by enhancing efficiency, improving risk management, and delivering personalized services to customers.

McKinsey reports Generative AI to yield business value in the coming years.

Here are a few areas GenAI can excel at:

Fraud detection

Generative AI models can analyze large volumes of transaction data to detect patterns and anomalies indicative of fraudulent activity. They can identify unusual behavior in real-time, enabling banks to take immediate action to prevent financial losses.

Customer personalization

Generative AI enables banks to offer personalized services and recommendations to customers based on their transaction history, preferences, and behavior. This enhances customer satisfaction and loyalty while improving cross-selling and upselling opportunities.

Product development and innovation

Generative AI can assist banks in developing innovative products and services by analyzing market trends, customer preferences, and competitive landscape. These models generate insights that help banks identify new opportunities and stay ahead of evolving customer needs.

Credit scoring and underwriting

Generative AI can enhance credit scoring and underwriting processes by analyzing diverse data sources and generating predictive models. This can help banks assess the creditworthiness of applicants more accurately and efficiently, leading to better lending decisions.

Predictive analytics to help accountants make better decisions

Predictive analytics is a type of AI that uses historical data and machine learning algorithms to predict future outcomes and make recommendations for budgeting purposes. This can be useful for businesses that want to anticipate changes in their financial landscape and make decisions accordingly.

PwC integrated a predictive model and data visualization tool into a large financial institution’s budget forecasting system. With the help of this technology, the financial institution was able to increase the profitability of payment activity flows, anticipate daily cash flow more accurately, and comprehend how different events affect cash flow.

Using the data at hand, the forecasting time frame was extended four times, from 3 to 12 months. But, most crucially, the data allows for more precise budgetary decisions.

Robotic process automation takes over repetitive tasks

Robotic process automation (RPA) is a type of AI that automates tasks that humans typically carry out. For instance, AI development can integrate with a business’s financial system to automatically categorize transactions and generate reports on the fly.

This technology is used to automate mundane and time-consuming tasks, freeing employees to focus on more valuable activities while ensuring accuracy and compliance with accounting regulations. It can speed up data entry, reconcile accounts, generate reports, and more. RPA can also identify and flag discrepancies or potential fraud in financial data.

Automated bookkeeping has long been a cumbersome and time-consuming process for accountants. However, AI and automation can make this process simpler and more efficient. Automated bookkeeping solutions use AI to analyze data and automatically enter it into the financial books.

Automated invoice processing is another time-consuming task that automation and AI can help with. AI can automatically read, process, and approve invoices accurately, eliminating manual labor and reducing the risk of errors or fraud.

Source: Unsplash

Credigy’s case of RPA implementation is worth noting. The multinational financial services company automated over 25 business activities, including automatic document processing via email, automatic uploading of documents to an internal system, automated forwarding of suspicious emails to scan URLs, automatic downloading of regulatory updates from various sites, and automatic uploading of data to specified tables for verification, Automating IT audits. The company’s business has expanded with an average yearly growth rate of more than 15% thanks to this decision.

AI can be a powerful tool for accounting departments. As mentioned above, AI technologies can help businesses improve accuracy, efficiency, and compliance while providing powerful insights to drive better decisions. As AI continues to evolve, companies should look for ways to incorporate AI into their accounting processes to get the most out of their financial data.

How beneficial is artificial intelligence in accounting?

The benefits of using AI in accounting are numerous. For example, it can provide faster processing times by reducing manual processes, improve accuracy by eliminating human errors, enable greater collaboration between stakeholders due to its predictive analytics capabilities, and increase productivity with less effort from staff members.

These are just some of the benefits of artificial intelligence in accounting that streamline processes and eliminate manual labor.

Increased efficiency

Most accounting tasks can be automated with the help of AI, allowing accountants to focus on more important tasks instead of wasting their time with mundane manual entries. This will enable them to process more data in a shorter amount of time, leading to increased efficiency and productivity.

Reduced costs

Automation reduces the need for manual labor. AI can help to reduce the amount of time and money spent on manual processes involved in accounting activities. This can be achieved by automating mundane and repetitive processes, such as invoice processing or data entry. Furthermore, AI can help to reduce costs by eliminating the need for manual processes, and the associated labor costs.

In addition, AI can help reduce the amount of human error in accounting. AI-enabled software uses algorithms to detect errors, ensuring that all financial data is accurate and up-to-date. This can save businesses from having to go back and fix errors later on, saving them time and money in the long run.

Improved decision making

AI technology can detect patterns and quickly identify outliers in vast data. By giving accountants access to deeper insights into their financial data, they can make better-informed decisions and respond more rapidly to market changes.

This means that businesses can better assess the financial health of their organization and identify potential opportunities to save money and increase revenue.

Source: Unsplash

Increased accuracy

Since AI eliminates the need for manual labor, it reduces instances of human error or fraud.

Integrating artificial intelligence into accounting has significant potential to improve efficiency, reduce costs, and provide more accurate results.

Automation

AI can automate various tedious tasks, such as data entry or audit verification, freeing up resources that a human accountant would otherwise occupy. For example, AI can automate data entry processes, tax filing, payroll calculations, compliance audits, budget forecasting, and more. This allows accountants to focus on more complex work and provide clients with a higher quality of service.

Better consumer sentiment analysis

People leverage AI is through consumer sentiment analysis. This involves collecting, analyzing, and interpreting customer feedback from various sources such as surveys, social media, and reviews. AI algorithms can analyze this data in a matter of minutes, providing insights into customer satisfaction, product preferences, and possible areas of improvement.

Accountability in AI

AI is a potent tool for a professional account manager, offering greater accuracy and speed in processing financial data. Algorithmic accountability should be at the forefront of risk governance regarding AI systems and machine learning.

Developing new accountability frameworks to systematically review risk areas, predictive value, and insights can help organizations identify potential risks and determine effective governance strategies.

Can AI replace accountants?

The use of AI in the accounting industry is a rapidly growing trend and could revolutionize professional account management in the future. But does it have the potential to replace accountants?

While AI is quickly increasing its presence in the accounting field, it is essential to note that machines can only partially replace human accountants. Accounting is a highly specialized field requiring knowledge of numbers and calculations and the ability to spot patterns, recognize errors, and provide sound financial advice.

Artificial intelligence systems are good at crunching data, but without human intuition, their capability to understand the “big picture” is limited without human intuition.

Source: Unsplash

For example, AI software can quickly parse a company’s financial documents. Still, it may struggle to spot an error or miscategorization that could have long-term implications for the business.

Additionally, accountants play an important role in interpreting laws and regulations, assessing risk related to new investments or markets, and providing counsel on how best to move forward – something that AI has yet to master. Even the most advanced AI programs can still not match human beings’ complex thinking, problem-solving, and creativity.

Accountants build client trust by performing regular audits and ensuring that a company’s financial reporting is accurate. An AI system cannot replace this relationship or provide the same level of assurance. It can be challenging for stakeholders to trust a machine over a human being regarding their finances.

The current state of AI technology cannot match the complexity of a human analyst’s or CPA’s judgment when making difficult decisions or interpreting data in a meaningful way. Accountants are still needed to ensure accuracy in complex financial tasks such as auditing or tax preparation. Instead, they work together to ensure accuracy and efficiency in the field. Accountants use AI to automate mundane tasks and reduce manual entries, enabling them to focus their efforts on more complex and strategic work, such as financial forecasting and planning.

Therefore, using AI in accounting should supplement the work of a human accounting professional rather than completely replace them. Nevertheless, applying artificial intelligence in accounting will undoubtedly become more commonplace moving forward.

To sum up

With artificial intelligence in finance, companies can remain competitive in an ever-changing landscape where technology is becoming more prevalent. By using AI in accounting, companies can gain a competitive edge by having faster access to data insights. They can make more informed decisions based on real-time data analysis and enable employees to focus more on strategic initiatives instead of manual tasks.

The use of AI in accounting also has the potential to increase efficiency and accuracy in areas such as auditing, tax compliance, payroll processing, asset management, data analysis, and fraud detection. For example, ML algorithms can detect anomalies in large datasets that human accountants may miss.