There’s hardly any business area that has remained resistant to artificial intelligence. AI in corporate finance, however, is among the least-talked industries to benefit from innovation. A conservative player, the banking sector and corporate finance area have always stuck with time-tested workflows until today.

However, in 2022, the positive impact of artificial intelligence in corporate finance has made companies take a closer look at smart systems.

How AI is changing the world of finance

Taking a stroll down the memory lane of corporate finance, we’ll discover that this sector has long stayed tech-suspicious. Finance 1.0, a period until 1908, used to be relationship-based. Finance 2.0, the recent financial era, became balance sheet driven.

As fintech solutions have entered the mainstream, we are closer than ever to a tech-savvy corporate finance era where all operations are transparent and automated. AI development and fintech have made a go at managing assets, liabilities, revenues, and debts for a business.

Source: Unsplash

According to Mordor Intelligence, the global AI in the finance market is projected to reach over $26 billion by 2026. The ever-high adoption rate is the direct result of the growing financial data and the demand for automation.

What can Big data do for finance?

Intelligent technologies are inseparable from Big data, which is a layer of all structured and unstructured information that comes at a great volume and pace.

Today, Big data is a business imperative for banking and financial companies around the world. The main reason behind the adoption uptick is that the financial services sector is among the most data-intensive sectors in the global economy.

Thus, according to a report, 71% of financial firms report gaining a competitive advantage by making effective use of information and analytics.

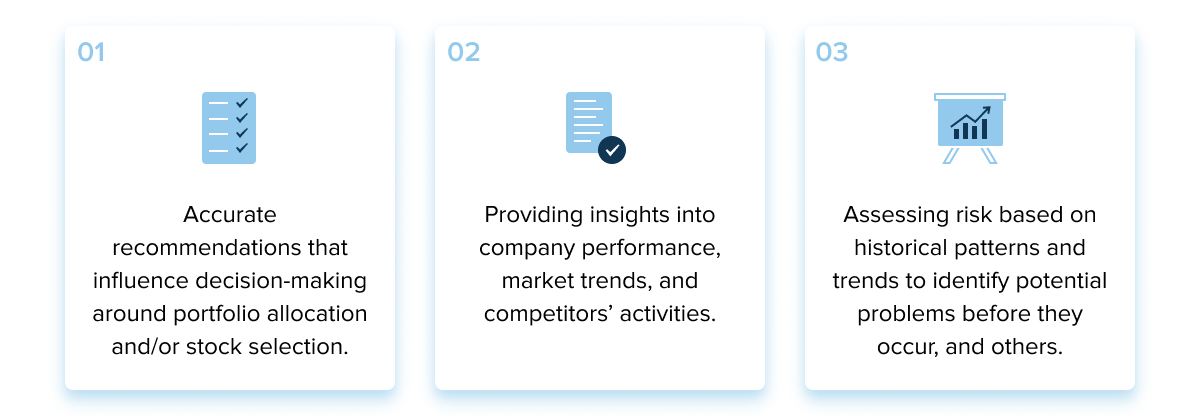

Moreover, feeding AI models with Big data can provide the following benefits:

This bag of benefits is joined by the infinite potential of AI in corporate finance.

Main benefits of AI for finance

In the past decade, financial institutions have made significant strides in their understanding of AI development and machine learning. Today, most of the world’s largest banks are using AI technology to foster innovation and boost customer experience. However, public finance isn’t the only sector to capitalize on technology.

According to Forbes, 70% of finance organizations employ ML algorithms to predict cash flow, improve credit scores, and avert fraud. Here are the main benefits of artificial intelligence in finance.

Source: Unsplash

Improvement in operational efficiency

Smart systems can help improve operational efficiency by automating data collection processes and enhancing decision-making capabilities. For example, an AI solution can model a company’s credit risk by predicting its performance during different market conditions — such as interest rate volatility or currency fluctuations.

This type of advanced analysis can help a company avoid costly mistakes and make better decisions. Thus, according to a report by Nvidia, 29% of AI adopters among finance companies have seen operational efficiencies.

Faster decision-making

Improved Big data analytics can help banks make better decisions faster than ever before. For example, AI systems could predict which loans will default more quickly than humans could on their own. This information can then be used to determine which loans should be renegotiated or liquidated swiftly without affecting the overall health of a company’s balance sheet.

Improved financial modeling

When a company grows, corporate finance and AI can also help manage investment banking. This powerful blend can add more insights to help investors make informed decisions about a company’s performance and long-term prospects. In addition to improving the accuracy of analysis and providing more options for investors, artificial intelligence also has the potential to make these analyses more accessible to all types of investors.

Robust security posture

The news agenda on hacking attacks are often associated with banking organizations. Thus, on January 9, 2022, the biggest bank in Finland, suffered a cyberattack that disrupted its services. The use of AI for finance fortifies proactive security measures for companies and allows departments to avert a cyber attack in banking before it wreaks havoc on internal operations.

Where is artificial intelligence in corporate finance applied?

The benefits of AI in finance seamlessly flow into its main application areas. Below, we’ve outlined the leading top cases of how smart systems can address funding sources, capital structuring, and investment decisions.

Risk management

Corporate transactions usually consist of loans or investments, which inherently expose organizations to liabilities and other risks. Artificial intelligence can help financial institutions improve the accuracy of their operational and risk management processes.

Response to risks usually follows the three-step pattern:

- Avoidance – companies get rid of a specific risk by identifying and removing its cause.

- Mitigation – reducing the projected financial value of a risk.

- Acceptance – creating a contingency plan to alleviate the repercussions of the risk.

Smart algorithms are mostly applied at the first two stages to develop preventive mechanisms for identified risks or manage present ones. Loan risk management, threats analysis, data classification, and others are some examples of AI-based systems for risk management.

Contract intelligence, for example, employs natural language processing to audit obligations hidden in complex contract language. JP Morgan Chase, for example, developed a proprietary ML-based platform, COIN, to process credit agreements with no manual effort.

Compliance excellence

On the same line, the duo of AI and corporate finance helps minimize risks for organizations by managing compliance. The creeping cost of compliance is an acute issue for finance companies. According to Deloitte, regulatory costs have drastically increased – over 60% for retail and corporate banks.

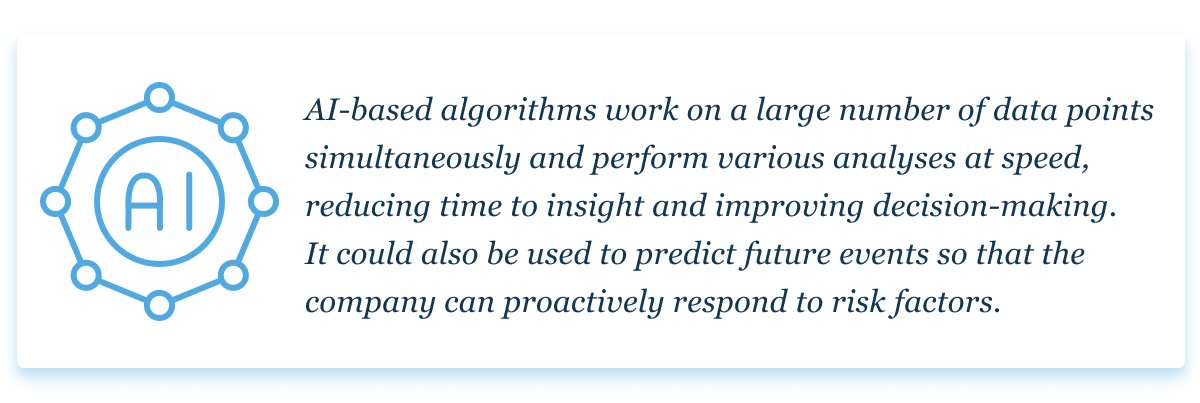

Machine learning, on the contrary, is less expensive to maintain when it comes to regulatory requirements. Algorithms process massive amounts of data in rapid time while analyzing countless variables. Also known as Regtech systems, these algorithms can scan and analyze any volume of regulatory activity.

For financial companies, the Regtech landscape is a vast technology field with a wide range of opportunities. Thus, organizations can leverage Regtech for compliance through robotic process automation, real-time data monitoring, risk prediction, and others.

As a result, organizations lower the risk of a human factor and can quickly analyze the ever-evolving regulatory landscape. By 2027, the market of Regtech is predicted to reach over $28 billion.

Portfolio optimization

Another crucial application of AI and corporate finance is automated portfolio optimization. Most of the time, human experts need to make a lot of decisions based on their experience and intuition. But with AI, they can remove much of this math from their shoulders by creating an algorithm that allows for automated decision-making.

The system takes into account the impact of taxes and fees, as well as inflation rates, stock performance, and other factors. As a result, a smart solution can accurately estimate expected returns and variances/covariances to calculate optimal asset weights. Algorithms can also tackle complex optimization problems, including a restricted number of assets or minimum holding thresholds.

Trading activities

The element of trading provides monetary instruments and products for companies to simplify international trade and commerce. Thus, importers and exporters can easily transact business through trade. Artificial intelligence is growing in popularity as businesses seek more precise and automated tools to improve their trading.

Capital budgeting

Capital budgeting is a process of estimating the costs and benefits of projects, which includes evaluating their financial impact on the firm. The approach is used to allocate scarce resources, such as cash and time, among competing projects. Capital budgeting involves considering the time value of money, risk, and uncertainty in decision-making.

To amplify the data-driven estimates of human experts, companies leverage AI for corporate performance management tools. The latter can assist in budgeting, capital allocation and even contextualizing corporate strategy. As the process of capital budgeting factors in the number of capital expenditures, an automated platform can calculate and combine them all with other associated data.

Risks and limitations of AI in corporate finance

The beneficial impact of artificial intelligence in corporate finance is hard to deny. However, smart systems are a double-edged sword that can backfire if used improperly. Here are the top risks associated with artificial intelligence corporate finance.

Risk: data leaks

According to IBM, the cost of a data breach stands at $4.24 million, which is an apogee of the last 17 years. Moreover, the data held by financial institutions is highly valuable and it’s important that it remains secure. Any leak could have serious consequences for not only the company but also its customers.

Source: Unsplash

The penalties can be monetary, damage the company’s reputation, disrupt the compliance practices of your organization or lead to litigation. This means that organizations will need to ensure that they have adequate security measures in place before adopting AI in finance.

Solution: develop a data governance strategy

Data governance promotes data security by setting standards for how data is accessed, stored, and protected. It also helps ensure that all of your organization’s stakeholders have a clear understanding of how to use data responsibly. It also promotes practices for protecting sensitive information from unauthorized access.

Moreover, data governance helps you meet compliance requirements. It ensures that any changes to your data protection policies are implemented consistently across your organization, preventing any potential gaps in security compliance.

Risk: algorithmic bias

The inaccuracy of algorithms is a common concern for adopters. Thus, 50% of executives report responsible AI to be their top priority. Another 32% are set out to address fairness in their AI algorithms.

Bias or algorithmic errors can creep into the system due to incomplete data or human factors. As a result, organizations can make adverse finance-related decisions that materially misgauge market trends or investment portfolios. Inadequate algorithm modeling can also lead to the system’s inability to adapt to new input. Finally, lack of system maintenance can provoke a concept drift, which impacts the long-term accuracy of machine intelligence.

Source: Unsplash

Solution: vetted talent and complete data

To eliminate potential bias, organizations should mitigate this risk in the early stages. By choosing an experienced team of data engineers, companies can drastically increase the accuracy of their algorithms. Moreover, complete and clean data is the lifeblood of an error-free system that generates accurate results.

Risk: lack of implementation traceability

The strategic implementation of smart systems is granular and targeted. Thus, adoption begins with a business case and a thorough understanding of the value the technology brings. With no strategy, organizations aren’t able to measure the performance, secure the right talent, and scale the system.

Solution: an adoption strategy

A documented adoption strategy will help the company to plan the AI integration with the business goals in mind. It documents the relevant use cases, infrastructure constraints, and data limitations of the company.

As a result, a company will have an accurate implementation plan that outlines cross-cutting issues, data strategy, and other important elements needed for successful adoption.

Source: Unsplash

Artificial intelligence and corporate finance: the final word

According to PwC, 86% of C-executives are planning to make machine intelligence their mainstream technology. While the application matrix may vary, the potential of smart systems well covers the area of corporate finance.

Intelligent systems can help companies make better decisions about mergers and acquisitions, identify fraud and prevent money laundering. Although the adoption rate hasn’t gotten into high gear yet, the data processing capabilities of AI have already proved beneficial for both the corporate and commercial areas.

Emplify your finance department with artificial intelligence

Need help with AI finance solutions development? Shedule a call, and our specialists will consult you on your project.