Have you ever heard about Big data, fintech, and what these two things are capable of when combined? The modern lifestyle is hard to imagine without data: our devices, which have been firmly integrated into our lives and simplified them, collect data about our habits, preferences, and behaviors.

As for the banking industry, the volume of data is growing by 700% per second. In terms of the total amount of data captured, copied, and consumed worldwide, there are 79 zettabytes. The amount of data collected continues to grow along with the rapid evolution of technology. On top of that, data has become a necessity for running a successful business, thus boosting interest in data across a variety of fields, including FinTech.

How exactly is data finding its way into FinTech?

FinTech Big data is useful for gaining valuable insights and transforming how companies build new business models. Big data analysis reveals a pattern about the target audience, helping businesses better services and craft products that are tailored more closely to the user’s needs.

All these advantages contribute to the better performance of financial institutions, banks, and companies involved in finance. These enterprises are backed by customized financial data accessed through Fintech institutions to get transactional data for the ongoing monitoring of what customers are doing across a range of channels and silos.

What is Big data in finance?

Data is not a new universe unveiling, and everyone has probably heard that it is collected for one purpose or another. But what about Big data? You may have heard the term, but do you know why data has suddenly become Big data?

Big data is complex and voluminous sets of diverse information. After processing these data sets, organizations can derive valuable insights that can benefit enterprises and institutions.

In fact, a treasure trove of consumer information can be found in these data assets that can revolutionize business strategy, including in finance.

Source: Unsplash

Big data’s value has already been realized in many fields, including finance. FinTech companies are helping finance companies extract that value from Big data. With the development of the Internet of Things (IoT), mobile technology, and more advanced authentication mechanisms, Big data will become more and more valuable.

Consequently, there will be more demand for FinTech companies, which, in turn, will continue to invest in data science teams to dedicate themselves to collecting and processing data.

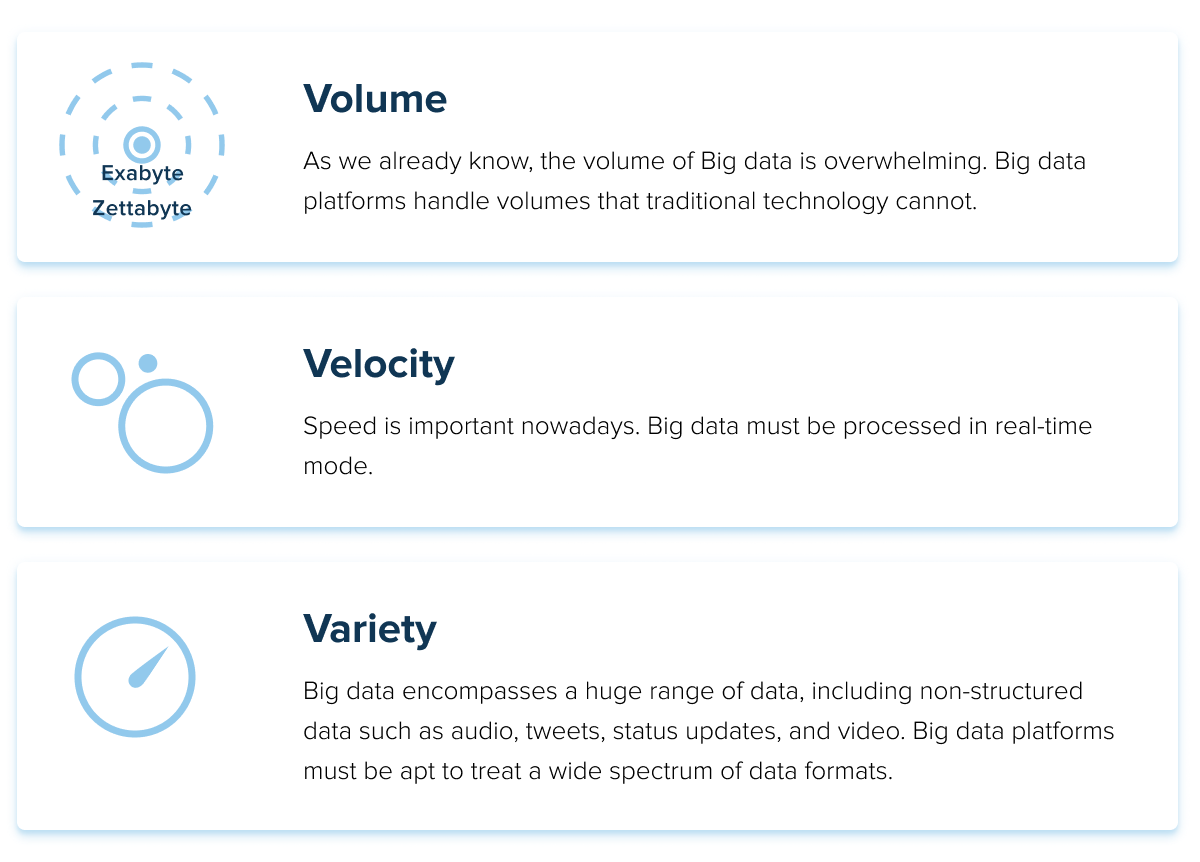

Now back to Big data. Volume, velocity, and variety are Big data’s three characteristics. They are also called V-characteristics. They are also the things that differentiate Big data from just data.

Let’s talk about each of them:

FinTech and Big data

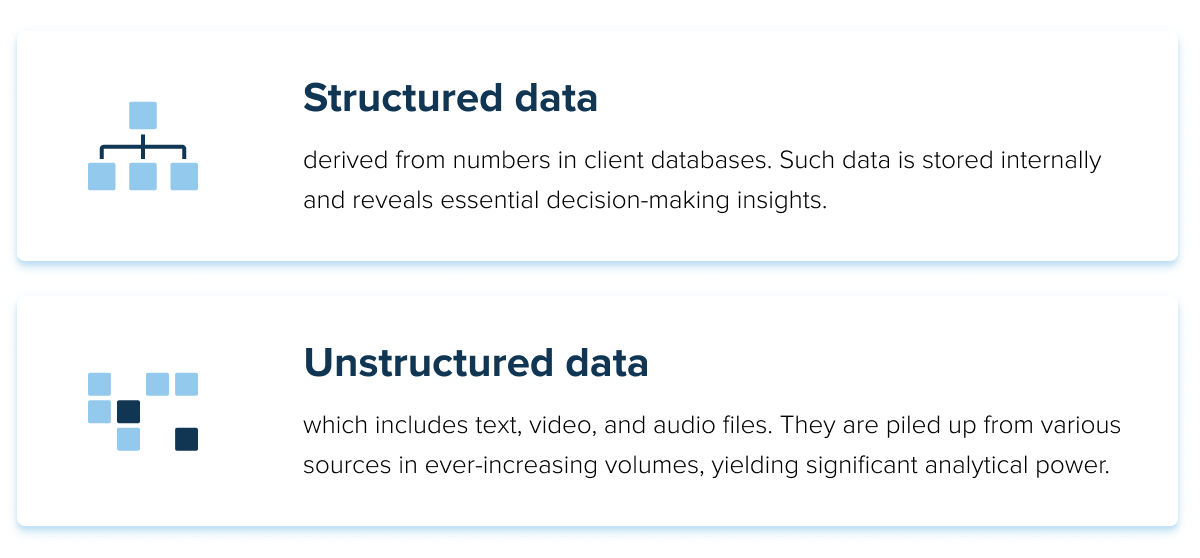

Big data can be divided into several types:

We can also distinguish semi-structured information, which is collected from several sources. The count of Big data in finance is already running to petabytes of data that can be used by banks and financial institutions to both foretell customer behavior and elaborate strategies.

As for Big data in Fintech, in addition to consumer behavior projection, it is being used for sophisticated risk evaluation, making more precise decisions, and offering a more personalized customer experience.

FinTechs can use Big data to understand their consumers on an almost personal level, rather than guessing or excessively cautious risk assessments.

Why does Fintech need Big data?

Big data has proven to be very useful in FinTech. FinTech helps modernize the sphere of financial organizations, adapting it to the new technologically empowered human life. In turn, Big data helps to make this real. Let’s take a look at why Big data is necessary for FinTech.

Going online

Our world is adapting toward technology progressively. Many processes are becoming digital and can be done on mobile and other devices. This is also happening in the financial sector. People are choosing to avoid going to banks and solving problems remotely. If we were talking about collecting basic data, this would be a barrier to collecting it. But not for Big data.

Through the use of mobile devices, Big data FinTech companies can get information about geolocation, more frequent user interactions, user behavior, and browsing history. All of this information is extracted from Big data and used to make up for the gap in face-to-face interactions with customers.

By obtaining customer data, FinTech companies can develop useful solutions that will meet the needs of the user. Which becomes a big advantage for attracting and retaining customers.

Social networks have valuable data for FinTech

Social networks have long been not only platforms for communication, but also for commerce. Users make purchases and interact with merchants on social networks. Because of this, FinTech companies’ interest in Big data from social networks is increasing.

For example, Big data on social media help banks assess credit risks in cases when a customer doesn’t have a credit history.

Customer expectations are changing

Without information about customers, companies can’t guess what they require. Big data helps FinTech companies not only foresee, but also stay ahead of customer expectations. This is possible thanks to Big data collected from multiple channels, such as mobile apps, websites, social media, and smart devices.

Thanks to Big data, FinTech companies can be more agile and react swiftly to shifting market environments because cutting-edge technology platforms power them.

Source: Unsplash

FinTech is becoming increasingly competitive

The rapid growth of the FinTech sector is driven by the advantages it offers to entrepreneurs, start-ups, and well-established companies. Through the use of Big data, FinTech companies can provide services that are crucial in this competitive industry. Their advantage is as follows:

- Thanks to Big data, or more precisely real-time FinTech data ingestion and processing, company operations can also be optimized on the fly. This facilitates the provision of quality services based on the needs of customers, which in turn have been exposed by Big data.

- Big data helps FinTech companies automate operational processes based on customer needs. Automating operations are cost-effective, allowing for more investment in marketing and lower prices for customers. Therefore, using Big data is a win-win option.

The benefits Big data brings to FinTech

As in all other spheres, the success of a FinTech enterprise lies in its clientele and, more precisely, in the level of customer satisfaction. In today’s technology-driven world, the quality of service, in turn, depends on Big data and its analysis.

Let’s take a closer look at the impact of Big data on Business.

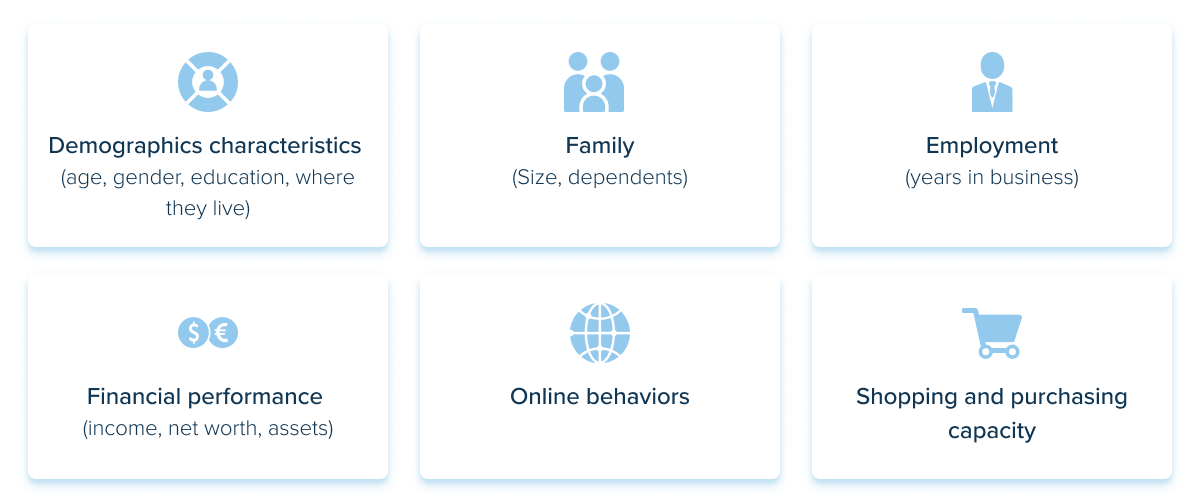

Improved customer segmentation

In fact, it’s quite simple. The more you know about your customers, the easier it gets to offer services that will benefit them the most and the better you can serve them.

Big data drives the building of a client profile and hence segmenting clients. Client segmentation allows you to learn more about your customers and tell you about:

Big data has made it possible for FinTech to analyze user profiles in greater depth and identify a portrait of high-value customers who are most likely to shop. To identify such customers, spending habits are analyzed and their relationship to age, gender, and even social class is revealed.

Thus, Big data in FinTech helps create more customer-centric products and services. For example, by having Big data and segmenting users, FinTech companies can launch promotions at the right time that take into account users’ spending power, which also becomes known thanks to Big data.

Choosing payment technologies and setting card limits that will suit your particular customers is also achieved through segmentation and Big data.

It turns out that thanks to segmentation, offers are no longer generic and become more tailored. And this, in turn, not only helps to attract customers but also contributes to their retention.

Finally, customer segmentation through Big data can also work to help FinTech grab a significant share of the market for its products. Thus, Big data presents FinTech with a unique opportunity to gain some competitive advantage and get in line with traditional banks.

Source: Unsplash

Customer-focused services

It’s a universal truth that people tend to go for services that meet their needs. Placing ourselves in the place of a client, we know that generic and non-specific services and products fall short. According to State of the Connected Customer research, 66% of clients would like companies to understand and meet their needs. How can a FinTech startup achieve this? Right, it’s all about data again.

Big data helps FinTechs get to know the customer all around and at an almost personal level. Data is collected everywhere: from card transactions, ATM usage, credit points, and other financial instruments, and the volume of this data is beyond comprehension.

With Big data analytics, FinTech companies can easily compile and analyze relevant insights into users’ banking transactions, identify pain spots, anomalies, and errors, and respond accordingly.

Source: Unsplash

User experience is what counts as a company’s reliability and trustworthiness. With increasing frequency, this experience is coming to mobile. Switchboards, operators, long queues at bank offices, papers, and never-ending hours of waiting to speak to someone on the phone or face-to-face are all things of the past thanks to FinTech, AI, and Big data analytics.

Digitalized simplification of finances is today’s preferred way of doing things. If your app doesn’t live up to its claims or isn’t as intuitive as it expected, it will hurt both customer experience and trust. Targeting a better user experience is what custom-centric service presents.

Improved fraud detection and security protocols

It would seem that everyone realizes that financial things should be protected to the fullest extent possible. But according to a study by Immuniweb, 98 of the world’s top 100 FinTech startups are vulnerable to cyberattacks. The numbers are catastrophic and may make users want to stop using any FinTech product, or at least inquire about the security practices employed in your product or service.

Unfortunately, it’s fair to admit that security issues are true for FinTech solutions. These products are cyberattacked on a regular basis, including phishing and security threats to web and mobile apps. The good news is that Big data can be useful to address this problem as well.

Security protocols and fraud detection algorithms are tasked with protecting users. Big data supplies information about what transactions people typically make, when they make them, what geographic location they make them from, and their typical behavior when using an app or website. With this information, Big data

FinTech companies have an improved understanding of how to create more robust security protocols and design payment systems so that they can withstand hacker attacks and fraudulent acts.

Source: Unsplash

As mentioned, Big data knows user behavior. Therefore, using this information in combination with data science, artificial intelligence algorithms, and ML helps identify fake behaviors. Until the transaction is completed, AI and ML send a transaction validation request to the competent department.

More streamlined operations

The use of Big data in FinTech is not a new phenomenon. We’ve talked about using Big data for sales, marketing, security, and customer service, but beyond that, Big data can be used in customer operations. We think it deserves just as much attention because operations predominantly determine the quality of the customer experience. And as you know, the better the customer experience, the more successful sales, and marketing.

“How can Big data be useful in the customer’s operational experience?” – you may wonder.

Big data can be a winning option for use in operations like risk assessment, loan servicing, human resources, and even legal department operations. With quick access to Big data, employees can make the right decisions faster, both in routine situations and in individual customer cases. This includes making service more personalized again.

In addition, with Big data, FinTechs can evaluate production, collect and review customer feedback to remedy shortfalls, pre-empt future needs and strengthen decision-making processes.

Source: Unsplash

More accurate credit risk assessment

In most cases, FinTech companies issue loans and credit cards. Credit risk scoring is one of the major challenges FinTech companies face. The challenge comes down to the lengthy and complex process itself due to limited data availability, a knowledge shortfall in data analysis, and poor availability of, and access to, data management tools. It’s critical to keep risks low.

Moreover, we live in a world where speed is king. This is where Big data comes into play. They speed up data processing as FinTechs take advantage of access to all the relevant information about their customers, past, present, and even future. Possessing this information, companies can assess a client’s financial condition even after a loan or credit card has been issued and detect any variations in order to mitigate risks. But that’s not all the benefits that come with Big data.

Big data in FinTech has eliminated the importance of credit history for risk assessment. Big data gathers information from social media, smartphones, and search engines to assess potential customers’ creditworthiness almost instantly. They can also send personalized marketing services to would-be low-risk customers.

It’s worth noting that we use the phrase “mitigate risk” because unfortunately, it’s not possible to completely eliminate all risks. But not everything is as dazzling as we would like it to be, and the FinTech industry still struggles with some Big data-related barriers.

Big data-related barriers in FinTech

In today’s world, privacy is of high importance. However, when it comes to the FinTech industry, concerns about data privacy serve as a constraint. FinTech companies must follow regulations that control how banking institutions collect information about their users, such as the Fundamental Review of the Trading Book (FRTB),Anti-money laundering (AML)/Know Your Customer (KYC), and Foreign Account Tax Compliance Act (FATCA).

Source: Unsplash

In addition, if FinTech companies follow the regulations currently in force, the companies’ business potential cannot be fully unleashed. In addition, the FinTech sector has difficulty making more complex decisions and BDA models for the same reason.

As the situation has changed, regulatory changes are essential. If changes are brought about, the FinTech sector will be able to further strengthen its potential to satisfy the customers’ needs.

Fintech Big data infrastructure requirement

While some countries are actively benefiting from Big data, others are just getting started. Adapting the use of Big data in FinTech requires a proper IT infrastructure. It is essential to cope with the sheer volume and variety of data and to sustain data quality. Its absence poses hurdles for the overall FinTech value chain.

IT infrastructure goes along with the proper tools and techniques, the use of which is essential so that Big data can be properly utilized and analyzed.

In addition to the technical component, implementing Big data also requires human resources and financial inputs, which is another challenge for FinTech startups.

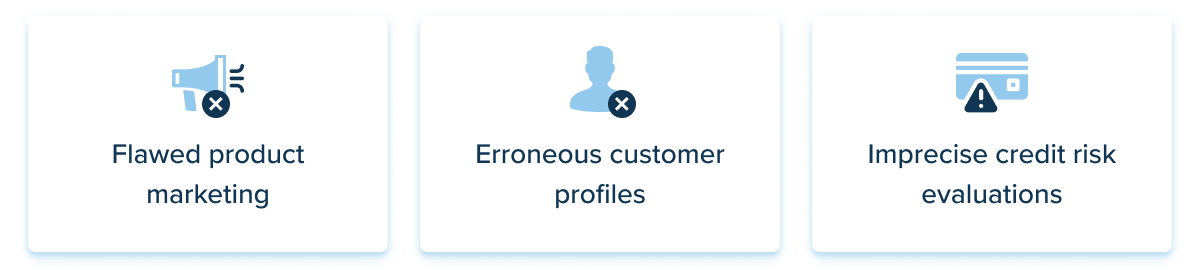

Substandard data quality

When faced with a huge amount of data, maintaining data quality is a struggle. However, data quality is vital in FinTech, as it determines the accuracy of Big data analysis and the integration of Ml and AI into FinTech companies’ value chains.

If data quality is unsatisfactory, FinTech companies run the risk of the following problems:

As you can guess, making and correcting such mistakes can cost a great deal, both for customers and for the companies involved. In addition, poor data quality can also compromise regulatory compliance, data privacy, and corporate image. In such cases, the penalty varies.

What is Big data analytics?

Data is collected from all devices such as smartphones, laptops, smart devices, etc. As mentioned above, the speed and volume of data collection are tremendous. But collecting data is one thing, but how to benefit from it is another. This is where analytics comes in.

Analytics of Big data is the ability to process large amounts of data. As far as FinTech is concerned, analytics helps you get more in-depth knowledge and information. In turn, it helps create smarter and more personalized customer services.

In this way, the best Big data analytics companies can change the world of FinTech by bringing game-changing benefits to both alternative financial institutions and traditional banks. Bringing benefits allows financial institutions to:

Machine learning and artificial intelligence are opening up even more new avenues for financial institutions, and the Fintech industry, thanks in large part to artificial intelligence and machine learning, can grow at a rapid pace.

This why today, financial institutions tend to abandon their usual business models and seek collaboration with Fintech companies owing to the opportunities afforded to them through Big data acquisition and analytics.

Choosing between Big data and Big data analytics

The difference between Big data and analytics of Big data is really quite simple. Big data is an accumulation of Big data-just a bunch of raw data. In turn, Big data analytics is the same Big data, but subject to analysis and structuring.

FinTech Big data analytics is considered more reliable and of higher quality. They can be used without bias and guesswork. Better data can further improve operations, sales, cost management, and so on.

FinTech and Big data analytics strengths

Big data analytics in FinTech is no less important than Big data itself. Big data analytics makes FinTech solutions stronger. Here’s a how it backs FinTech:

Strengthened decision-making

With the help of data analysis tools, a complete picture of the client’s situation is presented, which helps to make more well-founded decisions.

Source: Unsplash

An unbiased approach

Heterogeneity or insufficient data generates ambiguity. In turn, ambiguity breeds bias, which affects decision-making. Big data analytics in finance helps to eliminate bias.

Cost-effective and less time-consuming

Big data analytics solutions are replacing a lot of manual processes. That’s why Big data analytics in FinTech is considered cost-effective and less time-consuming.

Final note about Big data

Big data is proving to be the perfect ally for supporting a user-centric approach in a robust and scalable way. Big data in FinTech has already brought tremendous change, not only to within-company processes but also to the customer experience. It is the customer experience that has become the determinant and the main driving factor in changing customer expectations. In other words, FinTech companies have an offering that traditional financial companies don’t have.

Big data is expected to drive myriad finance-related entities. With the profound customer insights brought by Big data, the benifits Big data gives to business include but not limited to:

- Improved customer segmentation

- Customer-focused services

- Improved fraud detection and security protocols

- More streamlined operations

- More accurate credit risk assessment.

In overall, the mentioned benefits allow companies achieve service refinement and a more tailored product and service propositio. FinTech firms are the ones who are on their way to a smarter customer experience, which has got real thanks to Big data. Leverage the benefits of Big data to grow your company.

How to leverage Big data for your business

Seek out Big data development services by InData Labs, a certified AWS Partner. Our 80+ development team ready to help you leverage Big data and the latest AI technologies for business value and achieve a competitive advantage, improve overall performance and increase profitability.

Book a call to find out how Big data can be advantageous for your business.