The concept of harnessing artificial intelligence (AI) for business automation and transformation is sweeping the world. AI impact on finance, in particular, is cutting a dashing figure on the banking and financial sector. As a result, the market for artificial intelligence in finance is set to reach over $26 billion by 2026.

Be it a startup or an established business, those companies that implement AI for finance boost in-house processes and external contacts with clients or partners. Moreover, the pandemic chaos was caused by a surge of online and mobile banking channels across countries, as McKinsey suggests. As a response, almost 60% of financial-services respondents report the adoption of AI in finance.

Finance is ripe for automation

Artificial intelligence in finance and banking became a critical need for companies to stand out in a competitive market. According to OECD, the adoption of artificial intelligence in finance is driven by the growing availability of data and potential business value.

Source: Unsplash

By employing AI for finance, business owners can uncover a few new ways to upstage competitors through improved customer experience. In particular, finance companies turn to machine learning consulting to facilitate hyper-personalization through smart analytics. Moreover, automation can stop cyber attacks in banking, facilitate risk management, create new products and services, and transform customer services.

This bunch of benefits correlate with the current challenges of the banking industry.

Top banking industry challenges

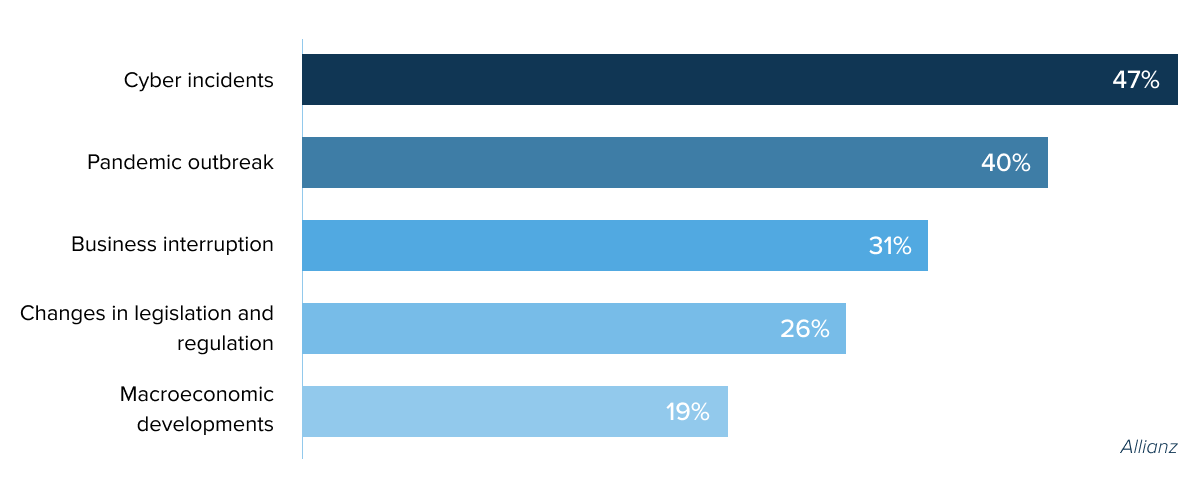

Most industries have found their traditional process upended due to the shifting landscape. The finance sector is not an exception. According to an Allianz report, the industry is haunted by 5 main risks. The latter cripple the serene existence of financial businesses and negatively affect revenues.

Cyber incidents

Emerging cyber threats for financial organizations are an acute issue in 2022. Ransomware, remote work risks, and vulnerability exploitation are just a few examples of alerts. In 2021, data breaches accounted for $5.72 million. Moreover, it takes around 287 days to identify and contain a data breach. And the damage the attack does during that time is insane.

Source: Unsplash

Pandemic crisis

While it might seem that the industry is over COVID-19, the aftermath is still strong. Long-term financial impact continues to linger on Americans. Thus, 40% of Americans now spend less money than they used to before the pandemic. As for banking institutions, they suffer from instability and high volatility in global capital markets. Moreover, bank valuations have dropped in all countries around the world.

Source: Unsplash

Supply chain disruption

Business interruption affects 31% of financial services. Much of it stems from the tech revolution that is needed to remain relevant. However, any tech introduction must comply with regulatory practices, and internal, and client needs. As a result, the time needed to meet the requirements hampers business processes.

Compliance issues

In 2021, Deutsche Bank has announced intentions to close 150 branches by the end of the year. Moreover, 90% of its workers will have the opportunity to work from home three days a week. This was mentioned as a cost-cutting measure as well as a means to stay up with changing consumer behavior.

Remote labor, on the other hand, adds another layer of regulatory difficulty for banks. Besides hybrid work setting, the finance sector is subject to a large number of other regulatory acts.

Source: Allianz

But there’s a silver lining in the bustle of the financial world. Artificial intelligence fintech solutions can address the gnawing needs of banking and minimize everyday risk.

How is artificial intelligence used in the finance

The application area of artificial intelligence in finance and banking correlates with the challenges thrown at the banking sector. According to Deloitte, artificial intelligence in finance and investments is employed the most in customer service. Companies also complement back-office operations with added automation value. The technology is being used to provide financial advisors with potential outcomes and minimize risk.

As for the rationale behind artificial intelligence applications in finance, it is used for financial decision-making for a few reasons. First, traditional software struggles with the complexity of financial products and the volatility of markets. To process real-time data, banks need to switch from legacy technology to machine learning solutions.

Additionally, AI can handle high-volume transactions quickly and efficiently, allowing financial institutions to optimize their operations and provide better customer service. The sheer volume of financial data mandates machine learning solutions to take the reign. With that said, let’s go over the main applications of artificial intelligence in finance.

Top applications of artificial intelligence in finance

The finance sector may be one of the last bastions of human decision-making, but that is changing. Robotic process automation and artificial intelligence in finance have spread their wings. Now, robo advisors can provide investment advice, while smart algorithms detect fraud and assist with stock trading.

AI biometrics technology in finance

Data security and access control are important part of creating a better customer experience. AI powers biometric identification and recognition solutions, such as face recognition, voice recognition, and fingerprint recognition.

Facial recognition algorithms verify a person by taking facial features from images or videos and comparing them to faces available in datasets. The technology then empowers AI security and can be used to ensure the necessary level of safety for both online services and within offices. Such biometric authentication as a protective measure can be expected to be widely used across the financial services industry – from established banks to AI finance startups.

Face IDs, for example, are a common offering among banks like HSBC, Chase, Citibank, Bank of America, and Wells Fargo. These financial institutions have already developed face recognition online banking apps.

Machine learning (ML) technology also allows machines to recognize voices based on such characteristics as articulation, pitch, tone, and so on. Voice recognition systems create and store a unique “voiceprint”. AI finance companies can then implement the voiceprint instead of or together with a password for making the user authorization process secure and smooth. In February 2019, HSBC pioneered voice recognition in services discharged to its customers.

AI in personal finance

Personal finance management is another brainchild of AI and finance. According to a recent FINRA research, 50% of participants felt anxious when discussing their money, and 60% felt stressed just thinking about them. A lack of financial literacy and money management issues are among the common triggers of financial anxiety.

Source: Shutterstock

Meanwhile, according to a recent Oracle research, 59 percent of Americans trust a robot with their assets more than they trust themselves. AI-powered fintechs are ushering in a new era of autonomous finance, and customers welcome automation.

Here, smart financial tools can assist customers in solving complicated financial issues. With no or little human involvement machines can give financial advice, empower better decision making, and increase customer retention.

Let’s take the Olivia app. It is a financial assistant app that relies on artificial intelligence and behavioral economics. The solution tracks patterns in your spending habits. And then uses those patterns to create money-saving strategies and optimize your monthly spending.

Risk management and laundering prevention

Limited risk management leaves financial institutions, firms, and households more exposed to shocks than they could be and is arguably a key factor in financial crises. AI and machine learning can take over many business processes that require working with large datasets. Applications of artificial intelligence in finance and economics will result in better forecasting decision outcomes, mapping out different ways of development, and helping companies pick the best-suited strategies to mitigate business risks.

Fraud prevention is another use case of artificial intelligence in finance and banking. To react faster to fraud and shield their clients, financial companies need to implement innovative AI solutions. Machine learning and deep learning technologies proved to be highly efficient in both preventing and investigating illicit financial activities.

Such algorithms are based on supervised learning, a type of model training approach that includes human reviewing of the output. ML-based solutions can work with alerts, scrutinize large datasets, or perform analysis of suspect transactions in no time and with high accuracy.

Changes to the loan system

Applications of artificial intelligence in finance and economics also extend to lending and loan management. AI solutions help banks considerably save time on lending procedures and reduce running costs. The analysis of forms can be automated, and human employees will only need to review the results.

For example, JPMorgan Chase, a US financial services firm, has adopted AI to analyze and process commercial credit agreements. They estimated that manual reviewing of 12,000 contracts requires up to 360,000 hours, whereas ML-based systems review the same amount in seconds. It demonstrates the great potential of AI tools to make in-house operations time- and cost-efficient and increase client engagement.

Support ticket processing

Processing customer queries is a real challenge for support services. When a support ticket is received, it passes through several stages before the right person can address the issue. Multiple routine efforts result in bottlenecks and a below-average customer experience.

Salesforce found out that 64% of consumers and 80% of business buyers expect real-time communications and responses from a provider company. Implementing AI for handling support tickets is the way to gain a better understanding of customer needs and exceed expectations.

Also, the use of natural language processing allows machines to read and analyze support tickets in a human-like way. Such ML techniques as sentiment analysis, ticket categorization, and keyword analyzer can help tailor a custom solution to specific support service needs. AI-powered solutions are scalable and can help achieve up to 100% automation depending on the nature of your business processes.

Use of artificial intelligence in accounting and finance

The use of artificial intelligence in finance supports the back office. More and more companies are turning to AI to automate various tasks such as bookkeeping, auditing, and financial reporting. This shift towards automation is largely due to the increasing availability of data and the advances in machine learning algorithms.

Automated systems can process large amounts of data much faster and more accurately than humans can, leading to increased efficiency and accuracy in the accounting process.

Optical Character Recognition (OCR) is a popular type of AI project development. This unique technology is widely used by banks to extract high-volume information. With OCR, banks can process, monitor, and evaluate vast amounts of data, be it internal reporting, client, or security information.

Some Asian banks such as DBS, Axis Bank, and ICICI Bank use OCR for innovative customer onboarding. By automatically recognizing customer details, optical character recognition enables a quick and compliant customer verification process.

How is artificial intelligence used in finance: summing up

Artificial intelligence is used in a variety of different industries, but finance is one sector that has been particularly transformed by this technology. Artificial intelligence applications in finance stretch through back and front offices as well as support positive customer experiences.

Today, AI in finance is a competitive asset that accounts for contextualized finance offerings, thus driving more direct and indirect profit for banks and credit unions. In the coming years, automation will forge new pathways in the industry and become a standard for personalized finance services.

Work with InData Labs on your AI project

Schedule an intro consultation with our Machine Learning engineers to explore your idea and find out how we can help.