Current AI trends in finance relate to automating the banking sector, including modernizing systems capable of managing complex, end-to-end financial operations and providing a competitive edge in the market, thereby enhancing security, fostering higher customer engagement, and redefining the industry’s digital landscape.

The fast-evolving financial management sector has been profoundly impacted by artificial intelligence and the adoption of AI fintech solutions. A large number of AI trends in finance are available today, representing a sudden shift from the traditional view of banking as simply executing transactions through a collection of financial products to an innovative method of fulfilling customers’ needs or meeting their requirements, without leading to a loss of jobs.

The use of AI in personal finance is increasing across various purposes and tasks, such as long-term cash planning and customer service, demonstrating its current success in leveraging these innovative technologies, including payments.

At the present moment, modern generative AI platforms such as ChatGPT for finance are able to generate complete, original text- and image-based content, code, and other creations, signalling a next move to progress in the bank.

By leveraging these priorities for business growth, organisations are more likely to achieve their operational objectives, and banks may now provide customers with a truly custom service and build up entirely new products, and come to wiser decisions.

The very changes in banking are being driven by the desire to enhance current procedures, save costs, investigate and capitalise on high-impact AI use cases, weigh potential advantages against risks, and develop creative prototypes into reliable solutions. This article focuses on AI personal finance trends in 2026. Let’s dive into them thoroughly.

Major financial trends driven by AI

More BI implementations will be possible as AI for accounting and finance changes in the future. These are the main current trends and functions, along with their effects on the financial industry.

Modifying customer relationship management

Artificial intelligence in finance gives a chance to adjust to the newest technologies, models, digital tools, and regulations. Moreover, all of these directly affect the quality of the client engagement as well as asset markets and corporate and investment relationships.

Due to financing future technologies, it has turned out to be increasingly important for enabling the continued innovation and transformation of banking institutions in responding to the fast-paced evolution of client expectations around the delivery of faster, more suitable, and better services.

Rather than simply suggesting products to customers, AI technology has advanced beyond that. The technology now creates customised financial plans for each individual based on how users transact online and the type of personalisation that they’ve received in the past.

With all this information, including the analysis of transaction behaviour and life events, AI can identify potential financial needs before the user or customer realizes it, such as securing a loan, and adapt its unique services accordingly to provide a more user-based experience, leading to all-time-high levels in business engagement.

Natural language processing, AI chatbots, and assistants behave like digital workers, performing multiple-step tasks as “digital employees”, while also understanding consumers’ emotional intent and tone. The benefit of this technology is also round-the-clock availability and the ability to provide answers to numerous questions across various channels, ensuring a seamless, omnichannel experience while preserving the user’s transaction context from the point of interaction to the point of sale.

Growing influence in all areas of finance

On account of the constant implementation of Big data analytics solutions in the banking sector, it has led to better service provision and communication with clients. Financial modelling, research in investment banking, improved risk control, and business lending are appointed as more efficient in comparison with previous years.

For instance, AI document reviews will support the streamlining of workflow in these issues. Likewise, due diligence and contract negotiations are aided by AI, as well as providing more accuracy to prevent mistakes due to human oversight and improve efficiency in both contract negotiation and due diligence review.

AI facilitates banking cybersecurity

The question about how AI affects cybersecurity is becoming much more prominent alongside other finance AI trends due to the dual impact that AI can have on cybersecurity networking.

However, it is a must to highlight that automation has a positive impact, but there are also some negative effects too. AI presents an opportunity to create new risks in cybersecurity due to its increased role in automating the processes of banking and improving customer experience.

For banking institutions, this poses two major issues. First, there is an ever-increasing expanded risk exposure for cyberattackers who may want to exploit AI’s expanded attack vector.

Secondly, as banks continue to grow their reliance on AI, each additional layer of dependence is creating more opportunities for cyberattackers to exploit a bank’s automated customer service solutions, thereby creating new vectors of compromise in the system of customer service automation.

Source: Unsplash

By harnessing AI’s state-of-the-art technology and tools, organisations can be provided with a valuable resource to defend their cyberspace from cyber attackers. With AI’s ability to detect, respond to, and learn about cyber threats, real-time protection fosters early detections. Patterns, anomalies, and other cyber threats are identified rapidly because of the large data sets being analysed and the AI for predictive analytics in finance, which allows attacks to be avoided long before.

Integrating technology into your business can have a tangible effect on incident responders, streamlining the processes that determine how they will respond to cyber incidents. In order to defend your business against cyber threats, you ought to continually learn and adapt your security through AI’s ability to dynamically learn and develop new security controls to protect your business against external attacks.

Comprehensive alterations in insurance, payments, and asset management

Generative AI has the potential to disrupt not only the banking industry but also other verticals, including wealth management, insurance, and payments, and fundamentally change how customers interact with financial services, complete transactions, and detect fraud. In asset management, machine learning has the opportunity to create more bespoke advice and assess customers’ risk by leveraging the analytics of data.

As far as insurance is concerned, the tools of AI enhance the efficiency of claims processing and improve the ability to determine risk. In the case of a collaboration with an insurance company, the work is accompanied by an AI insurance company to leverage for automating repetitive processes in claims processing.

Source: Unsplash

What is no less important is that it is considered to be one of the latest AI trends in finance in 2026, because of streamlining document processing, agents are now able to focus on more complex tasks, resulting in refined productivity, customer service, and overall efficiency. In addition, partnerships with top-notch AI firms are creating new models of delivering financial services.

Potential productivity due to AI integration and robustness

The key area of Big data development is also dedicated to future-proofing by applying AI to existing systems, combined with their scalability, which are critical components of a bank’s banking services stability.

It is aimed at potentiating the productivity in addition to developing human talent; banks must effectively manage their capabilities to deploy AI and be able to explain and justify the decisions made using AI. To learn more about the benefits of AI integration, please watch this video:

Continuously updating AI models and learning from the updated data, as well as adapting to new market conditions, are essential elements to successfully evolving in response to new data and market changes.

The future of finance with AI has enormous potential for growth and innovation in the banking sector, but it also presents a significant challenge. In order to capitalise on the benefits of AI, banks ought to work to address the major challenges of data privacy, proactive engagement with regulators, bias and accuracy risks, and cultural and strategic barriers.

By taking a holistic approach to AI in banking, it is possible to supply a technologically innovative solution while also providing an ethical and sustainable solution for customers and the financial ecosystem.

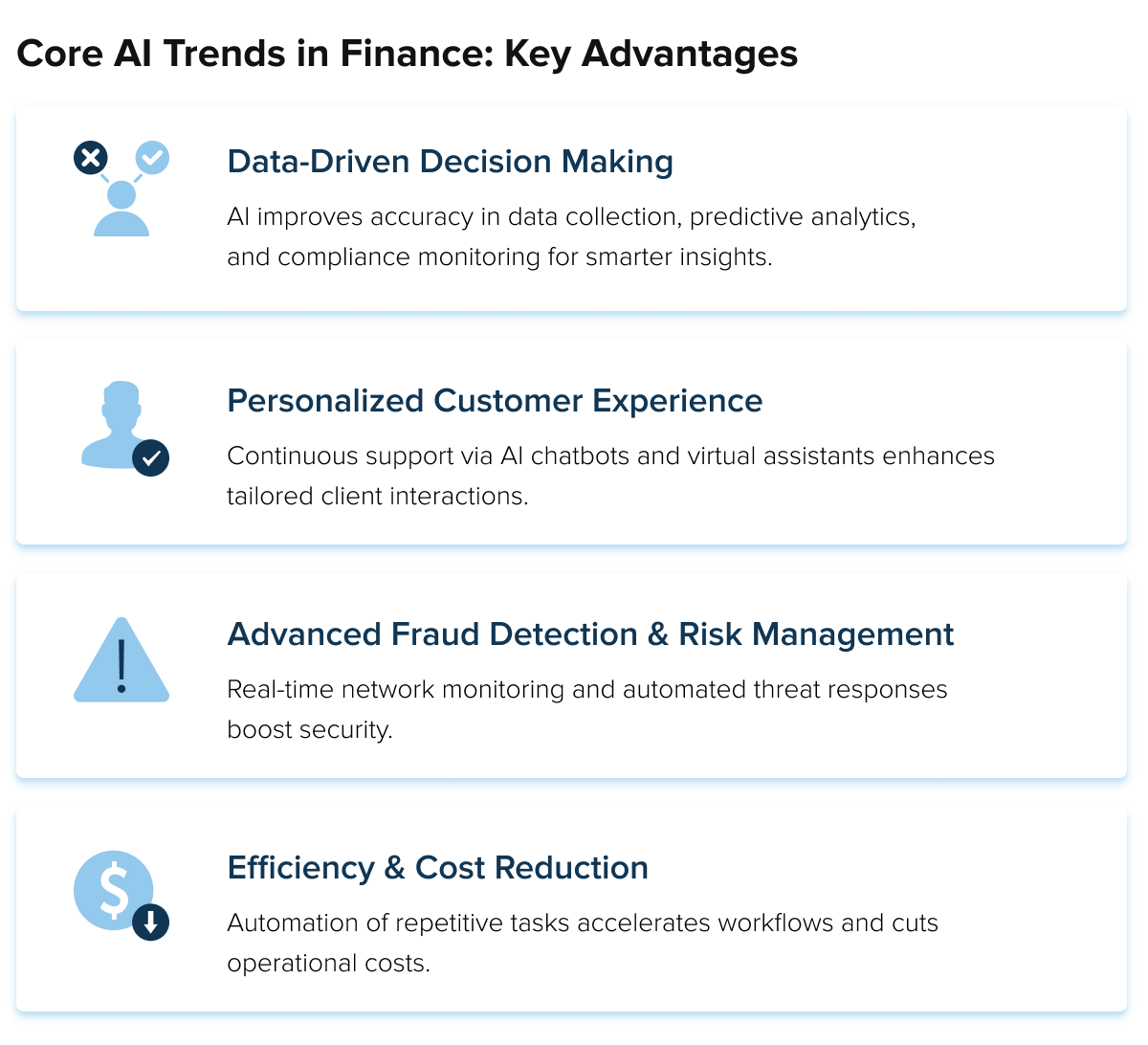

Uncovering AI trends in finance: Key advantages

Artificial intelligence unlocks the potential benefits that have a significant effect on financial strategy and helps make wise decisions; the main ones are:

1. Better decision-making based on data

More accurate data collection, insights, predictive analytics, and proactive monitoring of compliance lead to deeper insights.

2. Customer experience personalization

AI enhances the quality of the bespoke approach by providing continuous support, availability, AI chatbots, and virtual assistants.

3. Modification of fraud detection and risk management

Constant monitoring of networks for suspicious activity and threat detection, and automated response to help improve security.

4. Efficiency and cost-effectiveness

AI is embedded to automate repetitive tasks, speed and scale, and workflow streamlining.

How to embrace the opportunities of AI correctly

Paying attention to what’s coming next in banking is significant to enterprises, such as agentic AI, which allows people to perform multiple complex actions simultaneously through an advanced level of automation, and multimodal AI, which uses more than one type of data together to upgrade decision-making, allowing institutions to collaborate using AI while still adhering to their individual privacy policies.

As regulatory frameworks evolve, there will be a greater emphasis on mandated AI requirements from regulators related to improving the transparency in how algorithms work or an organisation’s level of risk, together with an increase in regulatory requirements meant to protect consumers from being misled by fraudulent processes within a company.

To take advantage of all of the AI opportunities, financial institutions ought to:

- Create an all-encompassing AI strategy by having clearly defined goals for implementing AI that align with business objectives around efficiency and reduced risk.

- Invest in the technologies and processes surrounding AI by dedicating capital to resources that support the creation and ongoing maintenance of AI/ML literacy throughout.

- Establish relationships with AI vendors who offer proven banking solutions along with their built-in governance controls and integration capabilities.

- Build and maintain customer confidence and trust through establishing a culture of transparency, implementing strong data protection policies, and ensuring human decision-making controls for critical decisions made by AI systems.

Conclusion

Wrapping up, AI in finance application trends for 2026 are making extremely big waves. With advancements in artificial intelligence, the influence financial technology trends have on banks is outstanding, as AI has grown to be something more than just an innovation.

Sustainable practices with the use of AI, partnerships with built-out platforms, and accommodating the differing requirements of international regulations and worldwide operations will all play a major part in how AI impacts the future of banking. More engaged clientele and customer-centric banking practices are moving forward by investing heavily in banking; the top banks in the world have proven their commitment to exploring new ways of applying AI.

While there are many positives to take from AI within finance and in particular banking, we must remain conscious of the potential issues and challenges associated with working with these technologies and using them within finance.

AI has a dual nature in the cybersecurity space, presents many ethical and social challenges, and places an increased emphasis on the use of data privacy. Each of these areas requires careful consideration and attention. Through the development of strong talent development, innovation and research, and strategic partnerships to address the challenges associated with these areas, financial institutions will be well-positioned to tackle the challenges associated with these areas now and into the future. Financial institutions have the chance to transform the financial services sector.

In the end, there is no doubt that balancing between artificial intelligence and human force is vital, as workers can pay more attention to more important issues and delegate mundane tasks to AI tools. The future of AI in finance doesn’t imply a gap or a loss of jobs; it is smart collaboration leading to the same objective by making your finance sector operate smoothly and efficiently.

FAQ

-

In the finance field, AI serves the primary function of automating operations like customer service and data entry. The next step after automating these processes would be using AI to assist in providing faster and more accurate data analysis to make timely decisions.

Through the use of machine learning and natural language processing, AI is an essential tool for enhancing risk management, detecting fraudulent transactions in real-time, and providing a more accurate assessment of creditworthiness compared to traditional methods.

Examples of technology trends in the finance industry include the following: algorithmic trading, tailored portfolio management, and analysis of market sentiment using advanced AI technologies.

-

The top 10 AI technologies changing the future of finance tools are the leading platforms, including Datarails, AlphaSense, DataSnipper, MindBridge, BlackLine, Trullion, Planful, Domo, HighRadius, and AppZen. Each is designed to help with the preparation of monthly reporting, budget forecasting, and regulatory compliance. What is more, the usage of these platforms will definitely result in improved productivity and the ability to produce reports with increased accuracy.

-

Yes, absolutely. Technology AI trends in finance are proving it to us. Artificial intelligence is seen as the next stage of the evolution of the financial domain. Once used strictly for efficiency, risk mitigation, and customisation, AI continues to experience an incredible increase in its footprint within the finance industry.

Referring to the view of experts, they suppose the future of finance will not be devoid of human financial professionals; however, they believe that in the future, the proceeds of AI will enable human financial professionals to work collaboratively with AI.

Machine learning can be expected to carry out the functions of data processing and automation, while humans will focus their business on strategic, ethical, problem-solving, and client-relationship management skills. Basically, future finance professionals will need to possess both financial knowledge and data literacy to fully benefit from AI technologies.

-