Invoice fraud cases can potentially become one of the top modern cybersecurity concerns in every industry — not just businesses offering fintech solutions and related sectors. Forging false invoices is one of many paths ChatGPT exploiters take when committing fraud. They intercept conversations as companies attempt to streamline business processes with generative AI’s productivity promises, yet end with misleading results.

Defenders use generative AI like ChatGPT for fraud detection as much as cybercriminals use it for invoice fraud. Analysts, developers, data scientists and business automation experts need to join forces in bolstering ChatGPT’s fraud detection proficiency. Drastic cases have happened already, signaling an urgency to prevent future occurrences.

Understanding ChatGPT and fraud

The beauty of generative AI is its inherent capabilities are ideal for detecting fraud. Fraud detection tools are any tech assets that notice, prevent and analyze fake activity, and ChatGPT does it all.

False invoices have the look of numerous cybersecurity classics, including:

- Phishing scams that lead to identity theft.

- Stolen credentials such as bank account and credit card numbers.

- Social engineering like manipulating or bribing finance teams.

- Distributed denial-of-service attacks that cause financial institutions outage.

Fraud detection and ChatGPT have their limits. Human intervention is essential. Though it acts as another set of eyes, cybersecurity fatigue discourages many in the battle against invoice fraud and counterfeit digital products. The struggle also fights against companies refusing to invest in cybersecurity and fraud detection adequately, leaving workforces to lobby for budgetary inclusion.

Where ChatGPT shines as a powerful tool

ChatGPT has an incomparable ability to process large amounts of data and invoices processed, despite any resistance to its corporate implementation. It is more accurate and prevents human error.

Natural language processing (NLP) is an artificial intelligence’s ability to use machine learning algorithms to understand language and its connotations. The large language models simultaneously construct believable invoices with sensible syntax and written composition and it detects invoice scams with the same ability. The set includes an amount of data that detects anomalies when scanning invoices, including the pixels in letterheads or the size of the margins. Trained AI can detect subtle differences — even if the suspected fake is legitimate, the instance is helpful for further training and analysis.

This is why ChatGPT fraud detection became popular and feasible — even when it is mistakenly classifying authentic invoices as fraudulent. There is always a benefit in training the data set.

Source: Unsplash

Navigating the pros and cons of ChatGPT in fraud detection

The countless GPT business benefits defend its usage as a cybersecurity and fraud detection staple. The more prominent advantage is its accuracy. Humans become familiar with corporate practices and business-to-business transactions, but the accuracy of ChatGPT in NLP is unparalleled. It exceeds the efficiency of manual scans and fraud detection. Cybercrime-prone sectors like financial services must pay special attention.

ChatGPT is adaptable, whereas sometimes human eyes become complacent and habituated to repeatedly seeing the same invoice data. It becomes instinctual to a point where it becomes harmful. AI-powered detection tools are more likely to execute novel fraud detection determinations.

An AI relies on its data set for consistency and ethical execution. Bias litters data sets depending on who supervises the information. AI hallucinations or frequent false positives occur if data scientists do not remedy poor saliency and content gaps. Companies relying on data scientists must consider their ability to fix the data in their favor if they have malicious intentions. Robust hiring protocols eliminate most concerns with this brand of social engineering.

How to identify fake invoices

Accounts payable experts must educate themselves on common invoice fraud trends and stay in touch with the news. Scammers and counterfeiters get more creative daily, primarily as publications reveal their secrets. A survey reported a collected $280,000 lost to invoice fraud over 2,750 companies, where 20% have between 21 and 30 instances in the same business. Awareness of the issue is low, despite it being the best medicine against threat actors.

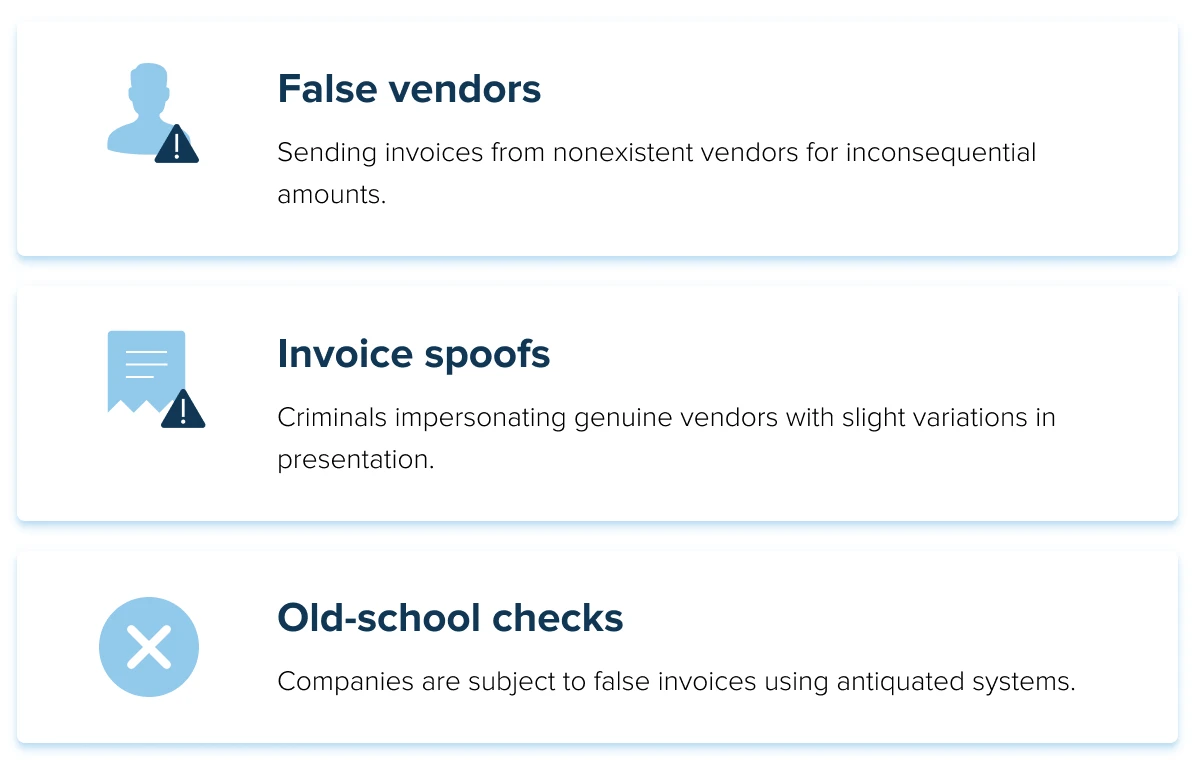

Digital hygiene practices are a solid foundation for detecting fake invoices, especially AI-generated ones. Spelling errors and slightly off email addresses flag for phishing and malware scams and the same is true for invoice scams. Knowing the major cons provide insight on how to detect a fraudulent invoice using AI-powered tools or not — though it can never hurt to employ them:

Additionally, if anyone detects suspicious activity, report it to the customer service of any related agencies — especially if invoices come from a reliable third party like Quickbooks or PayPal.

Using ChatGPT for fraud detection

Reaping the benefits of an AI fraud detection tool requires careful implementation in a company. You can integrate ChatGPT by discovering how it melds with other existing programs and services, such as OCR invoice software or intelligent document processing tools. Develop mindsets for questioning suspicious activity and review all invoices that come through digital doors.

Automating fraud detection becomes a possibility after gathering significant data for processing. Eventually, the invoice data set will be so specific that it uses feature engineering to discern expected variables, such as send times, with unexpected variants. This is how ChatGPT fraud cases use analytics for detection.

Model training grows with supervision and rule-based systems that reinforce with every case investigation, including instances and information like:

- Data extraction from documents, like names and addresses

- E-signatures

- Common contractual clauses

- Dollar amount ranges.

Invoice fraud cases

People have been creating fake invoices for decades. The way businesses respond to a case is different now, especially when a survey discovered 80% of telecom professionals who used AI assistants saw reduced costs in their work that helped company revenue. In addition, ChatGPT may have rendered these instances void if employing it for fraud detection during these years was common.

1. Evaldas Rimasauskas

Rimasauskas’s infamous incident on Google and Facebook is one of the most well-known examples of invoice fraud. For two years, he posed as an employee of Quanta Computer, a Taiwanese computer hardware company. Google and Facebook had relationships with the legitimate company, therefore never questioned when invoices flooded in from Rimasauskas. He netted $100 million using a fake email address from a Latvian copy of the corporation, pocketing the cash from the tech megagaints’ ignorance.

Google and Facebook might have caught Rimasauskas’s fraudulent activity in real time if employees scanned for suspicious activity with ChatGPT. Blockchain ledgers verify and authenticate transaction histories, keeping immutable financial records.

2. Paypal fake invoice scams

Blockchain is an invaluable resource for good, but it is flawed. In one incident involving PayPal, threat actors manipulated blockchain tokens to impersonate cryptocurrency companies. Then, they sent false invoices and estimates to PayPal sellers with links redirecting to malicious content.

Recognizable names like Solana and Bitcoin were easy to trust, mainly when they included customer service phone numbers if receivers contested or questioned the invoice and payment process.

3. Polar Rig specialties

In Texas, Jennifer LaBarge almost pocketed over $800,000 with fraudulent invoices from Polar Rig Specialties. LaBarge was an internal employee, working the books. She paid personal bills like auto loans, hidden behind manipulated metadata. The company used Quickbooks, and she got into a habit of disguising personal expenses under regular vendor names and codes.

Her sentencing required her to pay back the money, though the company was irreparably damaged by the incident.

Invoice AI can become proficient in noticing data manipulation like this. The company’s owner publicly announced how crucial frequent audits are, and ChatGPT covers bases until professional auditors and compliance experts double-check operations.

The future of invoice fraud detection

ChatGPT and fraud are inextricably linked as generative AI becomes more competent at protecting companies and individuals from invoice fraud. It forces companies to listen to experts, adapting to the dangers of online fraud landscapes.

It provides automation and peace of mind as artificial intelligence software development continues to impress and be one of the most valuable tools for detecting fraud. It requires continuous dedication to AI development, and the more industries commit, the higher defenses everyone will have.

Author bio

April Miller is a senior writer with more than 3 years of experience writing on AI and ML topics.

Integrate ChatGPT for business today

Planning to use ChatGPT in business? InData Labs can get you all set up to strategize, design, customize, and develop a solution for your business use case.