Banks and online businesses are constantly looking for ways to streamline and automate their Know Your Customer processes. Leveraging AI for KYC takes customer identification to the next, automated level.

According to a recent study by Research Drive, the global AI for the BFSI market is expected to garner a revenue of over $84 million in the 2021–2028 timeframe. In 2020, this number equated to around $21,067 million. Know Your Customer automation constitutes a salient part of this market and drives the efficacy of verification processes.

Stringent compliance regulations and evolving security threats are also responsible for the acute need for faster and less bureaucratic verification procedures. According to a report, banks saw an increasing number of monthly frauds in 2021. The total number spiked to 2,320 frauds per month. Ineffective identity checks are a common catalyst of sharp practices.

In this blog post, we will explore the basics of AI KYC and how thorough and fast the Know Your Customer process can be achieved through automation.

What is Know Your Customer?

KYC is an acronym for “Know your customer KYC,” a term used in banking and other industries to describe the process of a company verifying the identity of its clients and assessing their risk levels. This process helps firms stay compliant with financial regulations and hold back fraud. Another objective of Know Your Customer KYC is to prevent money laundering activities.

KYC procedures span a wide range of audits and verification processes, including:

KYC checks always rely on an independent and reliable source of documents, data, or information. Failing to meet KYC regulations exposes banks and other financial institutions to heavy penalties. In the U.S., Europe, the Middle East, and the Asia Pacific, a staggering $26 billion in fines have been levied for non-compliance with AML, KYC, and sanctions fines from 2008 to 2018.

Today, Know Your Customer principles apply to both financial institutions and online businesses.

How AI is helping KYC

Knowing the customer has always been at the forefront of banking businesses. However, multiple sanctions regimes and fraud prevention requirements have made KYC compliance a drudgery for companies.

According to SWIFT, over 90% of treasurers report that responding to KYC requests has become more challenging than it was five years ago. The vast data collection requirements make this conundrum almost unsolvable. According to AML experts, 80% of the time is spent on finding data instead of fixing problems.

Along with increasing data, traditional, rules-based Know Your Customer efforts are slow and manual. Not to mention, that they cannot prioritize alerts based on the money at stake. And that’s where AI software makes a difference.

Source: Unsplash

AI in KYC presents a new and faster way of payment screening. Due to the ample processing capabilities, intelligence finance systems can comb through gargantuan amounts of data in mere minutes.

Here’s how AI affects client KYC on a high level.

How AI affects client KYC: main benefits

Artificial intelligence is making waves in the customer identity and verification (KYC) space, with startups and tech giants alike racing to adopt or develop AI capabilities. As AI Know Your Customer software takes off, what benefits can businesses expect?

Reduced costs and time

One of the key benefits of artificial intelligence KYC is its ability to reduce costs significantly. Banks and financial institutions can cut costs by eliminating data entry errors as well as avoiding expensive non-compliance fines, and long onboarding processes.

Thus, intelligent identity verification can cut Know Your Customer costs by up to 70%, and improve speed by 80%. Moreover, automated facial recognition can streamline identification processes while automated document analysis can decrease the time taken to review documents.

Source: Unsplash

Fraud prevention

KYC fraud detection procedures evolve around three steps. These include customer identification procedures, transaction monitoring, and risk management. While manual input is possible at all three stages, automated algorithms can perform these tasks faster and more accurately.

In this case, smart models can detect whether the image was manipulated and verify the information against various databases. As for transaction safety, Know Your Customer software can help spot suspicious or illegal transactions in real-time.

Better compliance

The ability of AI fintech solutions to identify patterns in a vast amount of text data also leads to better regulatory compliance. Natural language processing, for example, can sift through documents and extract meaningful data. The latter may include client identities, products, and processes subject to regulatory change. As a result, banks and financial institutions can keep up with the regulatory landscape with the least effort.

Higher customer satisfaction

Moreover, AI-based KYC service boosts customer satisfaction by enabling faster and high-quality onboarding processes. Thus, automatic data entry, image checks, and verification minimize errors. KYC automation using artificial intelligence also reduces the possibility of erroneous off-boarding for legitimate customers.

Source: Unsplash

How is artificial intelligence KYC used in banks?

The traditional KYC process is vulnerable to all kinds of risks. Money laundering, identity thefts, and erroneous verification decisions haunt risk management in global banks. According to SWIFT, 72% of payment exceptions were the result of formatting errors, account issues, and invalid data. Increased regulatory scrutiny also leads to slower onboarding times, thus requiring automation.

With that said, let’s see how AI-based KYC software can tip the scales in this field.

Client risk profile

AI KYC is changing the way banks and other lenders assess risk in their clients. In the past, human underwriters would study a loan applicant’s credit history and other financial data to approve the loan. This process was slow and expensive, leading to longer TAT.

Moreover, siloed data is another challenge that hampers effective risk assessment. Thus, most companies keep data segregated in different systems. This isolation leads to a one-sided risk profile for the customer.

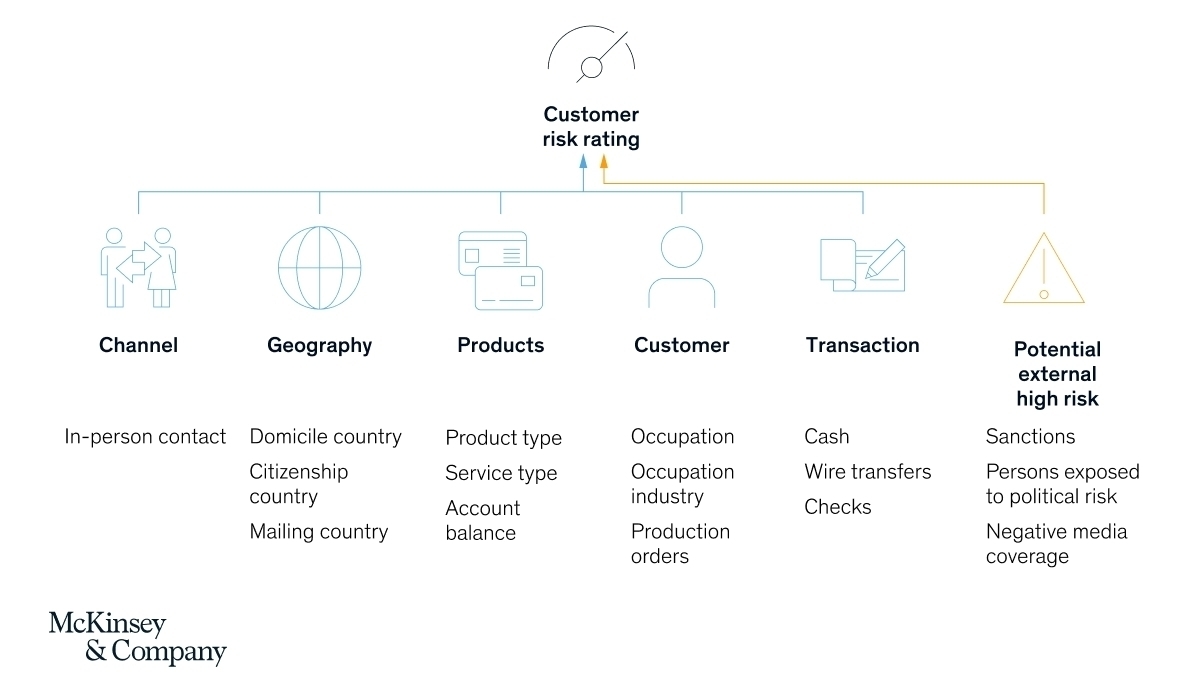

Conversely, AML risk rating models facilitate risk detection by analyzing a comprehensive set of criteria. According to McKinsey, smart programs align all risk scoring models to a consistent range of risk factors. After that, they identify the specific inputs that are relevant for each line of business.

As a result, businesses can perform meticulous audits with little to no manual input. By establishing a single client view, banks can automatically surface likely matches and high-risk client profiles. Ultimately, banks will be able to comply with anti-money laundering regulations thanks to an integrated view of client assets, identification, and risk.

Intelligent document processing

Transforming KYC document workflow is another application of AI-based KYC. As client onboarding is becoming increasingly important, financial institutions tend to spend much effort on manual checks. Moreover, 70% of companies struggle to deliver a positive customer experience during onboarding.

AI in KYC can facilitate onboarding by applying optical character recognition. Thus, instead of manually scanning through documents, companies adopt an OCR-based process:

- The customer begins the identification check by taking a snapshot of their ID and uploading it.

- The software retrieves all data, including signatures and photographs, and turns it into a computer-readable format.

- The new customer will then see the extracted data automatically placed in the form and will only need to validate it.

- This data is also processed by the program, which compares it to the ID data.

If they match, the onboarding is complete.

Source: Unsplash

The OCR technology may be used to scan any document holding information about a potential customer. It identifies the text it requires and extracts it automatically. The retrieved data can then be passed to any system, database, or tool for additional processing. Therefore, intelligent software eliminates data entry and minimizes errors during the Know Your Customer process before onboarding.

Biometric identification

Biometric facial recognition binds individuals to their digital identity. Like no other authentication method, biometric identification analyzes unique physical attributes such as fingerprints or facials to prevent identity theft. No wonder, this verification method has become a popular asset in Know Your Customer software.

Currently, biometrics helps banks compare a selfie with the facial landmarks in the photograph featured on an ID document. Chase, Bank of America, Citi and Wells Fargo have all introduced biometric ID options. The latter include voice, fingerprint, eye, or facial recognition. Mastercard and Visa are also launching payment cards with embedded fingerprint IDs.

Real-time transaction monitoring

AI in KYC automation can also guard off hackers and money launderers by identifying suspicious behavior in real time. Real-time transaction monitoring has always been a nightmare for banks. Outdated software couldn’t keep pace with payment batches and their instant processing.

Thanks to robust processing abilities, smart algorithms can now analyze vast data pools and flag even a subtle unusual activity. Moreover, AI-based KYC software can make predictions about a customer’s financial pattern based on the available data. As for compliance, smart functionality can keep a check on whether the payment aligns with regulatory expectations.

Overall, financial institutions can leap to KYC AI to get their unstructured data under control. According to analysts, finance companies face up to 90% of unstructured data. This, in turn, cripples full compliance and leaves a lion’s share of information hidden. Smart data science solutions can convert data into structured formats through document processing, thus making it accessible for thorough checks.

Adopting KYC AI: main challenges

Introducing something as sophisticated as an AI-based KYC platform inevitably brings complexities to established processes. However, staying aware of these can give you a heads up and minimize the innovation backlash.

Poor data preparation

Any kind of artificial intelligence in software development feeds on massive amounts of data. Therefore, model training requires troves of accurate and complete data to produce a high accuracy score. However, as companies struggle to create a single source of truth, historical data gets scattered across branches.

As a result, banks and credit unions fail to adopt automation. To solve this issue, organizations need the reliable expertise of data science teams. The latter will help get hold of all data by establishing data lakes and making insights available for all branches.

Artificial intelligence bias

Know your customer KYC process is highly susceptible to algorithm bias. This phenomenon is a direct result of erroneous assumptions in the machine learning process. In this case, an algorithm generates systemically prejudiced results. The main reason behind it is either poor data or human trainers. To avoid this problem, a smart algorithm should be trained with representative data sets.

Employee training

Insufficient staff proficiency is another bottleneck on the way to intelligent Know Your Customer software. This understanding is critical as companies democratize the workplace by introducing AI in KYC. Therefore, AI adopters should invest in comprehensive staff training to make the shift beneficial for both sides.

Source: Unsplash

Customer satisfaction

People are more accustomed to human interaction. Therefore, the transition to automation should be managed in light of customer expectations. For example, companies can send notifications to newcomers and loyals that explain the main benefits of handling verification through automated systems.

Source: Unsplash

Changing regulation

KYC regulations and anti-money laundering regulations are fleshed out in national standards. However, most of them are technologically neutral. Therefore, before switching to KYC using AI, organizations must check the current legislative landscape.

Currently, a few European countries such as the United Kingdom, France, and others allow full usage of AI-based KYC. Other European countries allow video verification only. Thereby the type of automation should be up to current limitations and be regularly updated according to new legislation.

AI is the next KYC frontier

Once a wild west, artificial intelligence has entered even the most conservative areas. The rising cost of compliance and the need for automation have prepped the Know Your Customer process for the AI revolution.

Being a complex and data-intensive process, customer verification can benefit from powerful AI processing and automated onboarding. Ultimately, AI-enabled KYC systems drive down fraud rates and make banking decisions faster, more intelligent, and more customer-centered.

Leverage AI technology for KYC with InData Labs

Need help with AI-driven KYC projects? Contact us, and we’ll share your ideas with you.